Employers can make a difference in the lives of their employees by helping them prepare for their transition to retirement.

Effective communication and financial wellness education empower employees to make smart financial decisions and better prepare for retirement.

Almost half of working Canadians admitted that stress related to personal finances has impacted their performance at work.[3] Employers that invest in the financial well-being of their employees can benefit from a healthier and more productive workplace.

Five steps to helping employees prepare for retirement:

-

Build awareness around retirement benefits from the Government of Canada:

-

-

Canada/Quebec Pension Plan (CPP/QPP) benefit payments are based on the number of years an individual contributed to the plan and the total amount they contributed during their working years

-

Old Age Security (OAS) benefit payments are based on the number of years a Canadian or permanent resident has lived in Canada once they turn 18

Direct your employees to the Government of Canada website to learn more or to My Service Canada Account to check how much they can expect to receive in retirement.

-

-

-

Offer and encourage participation in a company-sponsored retirement savings program:

Sponsoring a retirement savings program is an easy way to support your employees in saving for the future. If you currently offer a program, make sure they know how to access information on the insurance provider’s website. Encourage participation in the program by outlining some of the benefits including:

-

-

-

-

-

Automatic contributions through payroll deductions

-

Tax benefits of a registered retirement plan

-

Competitive investment management fees that provide cost savings

-

Easy access to financial tools and resources

-

-

-

-

Provide information on decumulation:

Decumulation refers to converting accumulated savings into an income stream. This income stream can either be a guaranteed or variable:

-

-

-

-

Guaranteed decumulation products provide increased financial security as they guarantee an income stream for a specific period. Examples of guaranteed decumulation products include CPP/QPP, defined benefit plans, and annuities

-

Variable decumulation products keep savings invested providing future opportunities for growth. Since savings remain invested, income streams will vary depending on market returns. Examples of variable decumulation products include defined-contribution plans, registered retirement income funds, and life income funds

-

-

-

-

Encourage employees to think ahead:

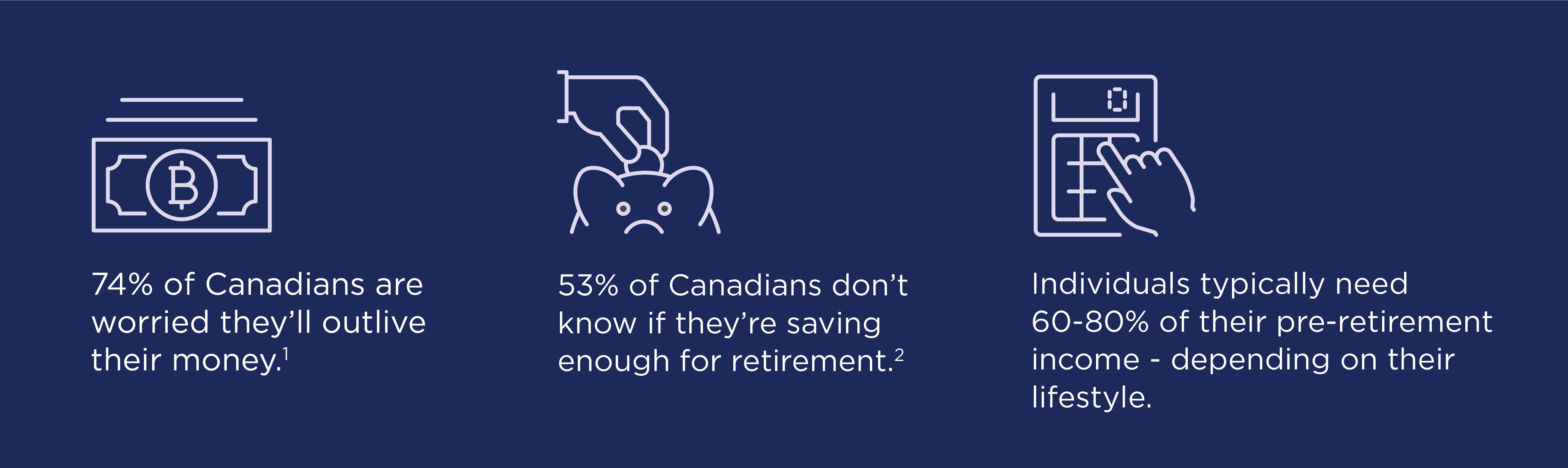

It’s important for employees to consider what retirement will look like. They need to be aware of the expenses they’ll have and how that amount compares to their potential income. Identifying possible shortfalls during working years allows for adjustments to savings plans and better overall financial health in retirement.

The emotional impact of retirement should also be considered. There’s a major shift in lifestyle which can lead to anxiety, depression, and family disputes. For some, easing into retirement gradually with a reduced work schedule or part-time work is better both financially and emotionally.

-

Promote financial planning tools and resources:

Sharing financial planning tools and resources with your team helps support informed decisions. The Canadian Retirement Income Calculator can provide an estimate of retirement income from various sources. Encourage your employees to review their finances with a financial planner to ensure they’re on track to meet their financial goals before and during retirement.

Additional considerations:

Ensure you’re offering a competitive company-sponsored retirement program to support the financial future of your employees. Including resources such as checklists and action plans can help them prepare for their transition to retirement.

Let us help you set your employees up for retirement success – contact our GRS representatives today to get started.

Written by Salina Shariff, Senior Director, Retirement Solutions & Financial Wellness & Taylor Clancy, Client Support Specialist

References:

1 https://angusreid.org/retirement-in-canada/

2 Canadians and their Money: Key Findings from the 2019 Canadian Financial Capability Survey - Canada.ca

3 Financial stress and its impacts - Canada.ca