Welcome to the second instalment of our seven-part series, Sanofi Insights – a series of articles created to breakdown the key takeaways from the 2020 Sanofi Healthcare Survey results.

Shifting attitudes amongst plan members

One of the most interesting questions the Sanofi Healthcare survey asked of plan members was how they viewed and used their benefits plan. This year’s responses highlighted an important shift in thinking compared to the responses provided in the 2016 survey. The response choices were:

- [I view/use my plan as…] “extra compensation and try to use it as much as possible to get money’s worth.”

- [I view/use my plan as…] “a way to help take care of health and try to use it only when sick or to prevent illness or injury.”

- Or [I view/use my plan as…] both choice one and two.

22 percent of plan member respondents selected choice one, reflecting that these participants view and/or use their plan as extra compensation, and they try to use their plans as much as possible to get their money’s worth. This choice went down in popularity, as compared to 35 percent of respondents selecting choice one in 2016.

60 percent of plan member respondents selected choice two, reflecting that these participants view and/or use their plan to help take care of their health, and they try to use the plan only when they are sick or to prevent illness or injury. This selection was up in popularity from 43 percent in 2016.

Lastly, fewer plan member respondents selected choice number 3, “both” in 2020 than in 2016. The number of selections decreased from 23% to 18%.

Shifting attitudes amongst plan sponsors

Another key takeaway focused on plan sponsors. In the 2020 survey, among plan sponsors were surveyed, the most popular reason cited as the “main purpose of offering a group benefits plan” was to keep employees healthy and productive.

In 2014, the top response was to provide peace of mind for employees. While these responses are similar in that they’re both altruistic and employee-focused, the shift toward recognizing that health plays a part in employee productivity is certainly noticeable.

A desire for greater flexibility in benefits plans

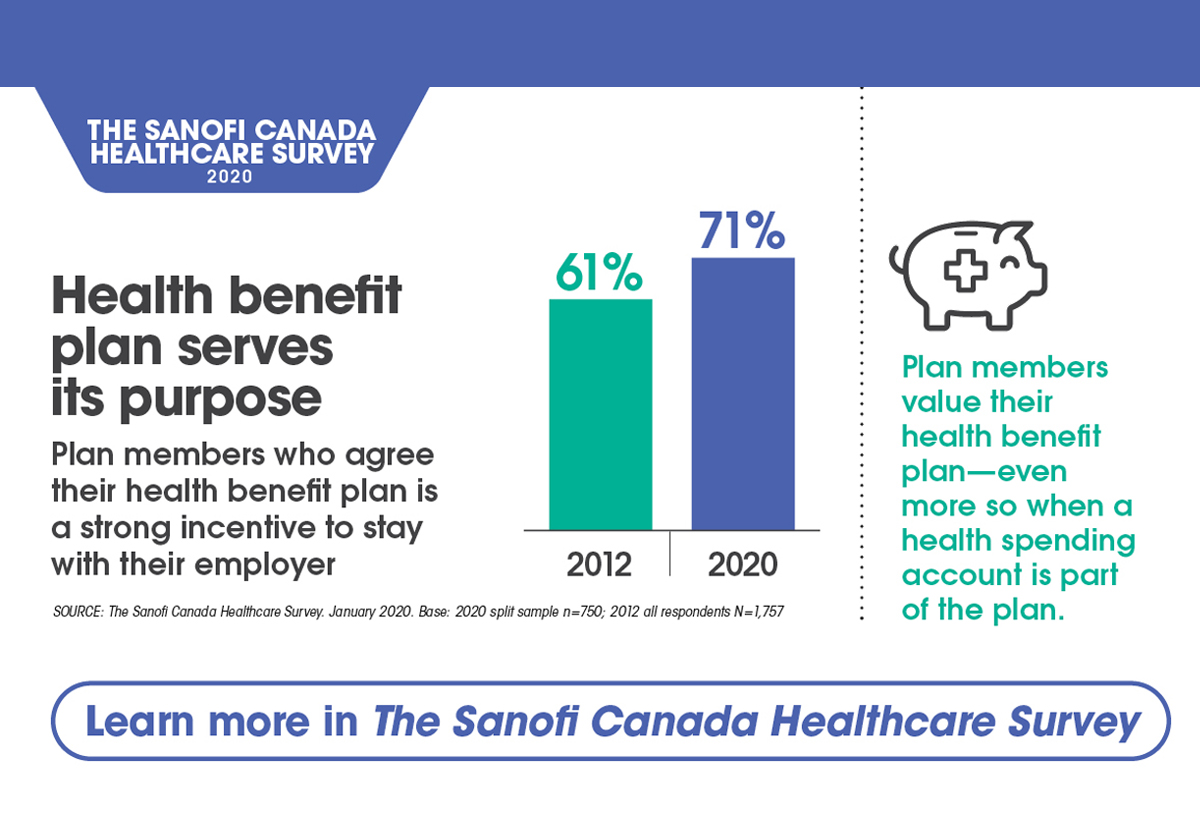

The desire for flexibility within benefits plans is clear throughout the survey results. Plan sponsors were asked specifically about whether they offered health spending accounts (HSAs), wellness accounts, and/or employee assistance programs (EAPs).

Of these options, EAPs are the most popular “flexible benefit,” being included in the benefits plan offerings of 61 percent of plan sponsors respondents. The prevalence of the HSA as also high (at 57 percent), while wellness accounts hovered around 35 percent.

When plan members were surveyed about their HSAs, it was clear that the benefit was both valued and utilized. When asked what percentage of their HSA was utilized in 2019, most plan member respondents reported their utilization rate at 50 percent or higher. Many plan members who had credits remaining at the end of 2019 reported that they simply didn’t need to use all of what they were entitled to.

Interestingly, a large portion of the plan members surveyed who did not use their HSA at all said either they forgot about it, they felt it was too complicated or time-consuming, or weren’t sure what HSA dollars could be used for. This key insight reinforces the need for clear communication around benefit plans to ensure plan members understand how to use their coverage.

Highlighting the need for clear feedback

A recurring topic throughout the Sanofi Insights survey was the importance of regular feedback and active benefits plan management. The survey posed a question to plan sponsors inquiring whether they receive reports or analyses of their plan’s claims data.

- 69 percent of plan sponsor respondents received this type of data

- However, among the 69 percent who received the data, 43 percent reported only receiving the data occasionally, or worse, only when requested

When claims data isn’t reviewed, plan sponsors miss the opportunity to analyze trends, understand their plan activity, and evaluate coverage gaps.

If your organization could use a partner to help examine your employee benefits offerings, meet People Corporation.

People Corporation is a leading provider of group benefits, group retirement and human resource services in Canada. No matter where our clients are located, they can benefit from a national partner delivering local service.

We have offices across the country, each backed by a team of experts and the resources of a national firm. Click here to start the conversation.